Protect Your Future With Tax-Free IULs

Strategies That Keep You Covered - and Confident.

About us

At Roddy Life Planning Group, we help individuals and families build smarter financial futures — with personalized insurance strategies that work. With over 30 years in the financial industry, our team connects you with powerful tools like Indexed Universal Life (IUL), living benefits, and retirement income planning.

Whether you're planning for the future or protecting your family today, we provide professional, unbiased guidance to support your long-term goals. Backed by a nationwide network of experts, we're here to serve you with integrity and care.

Our Services

We offer smart, personalized insurance solutions designed to protect your future and help you build long-term, tax-free retirement income.

IUL – Indexed Universal Life Insurance

Build long-term, tax-free retirement income while protecting your family — all in one flexible policy.

Living Benefits

Access funds while you’re still alive in case of illness or injury — no waiting, no stress.

Retirement Income Planning

We help you create a stable, tax-advantaged income stream that lasts through retirement.

Rollover IRA

A retirement account that allows you to move money from your former employer-sponsored plan to an IRA—tax and penalty-free

Avoiding common Retirement Traps

Dedicated Support

Why Choose Us?

With 30 years of award-winning service, we bring experience, trust, and real results. Our firm provides customized life insurance solutions designed to grow wealth, reduce taxes, and protect what matters most — your family and your future.

We’re not tied to any single product or provider. That means we put your goals first, every time. Supported by attorneys, CPAs, and a network of trusted professionals, we offer nationwide expertise with local care.

Your life is unique — your insurance plan should be too.

Safe Plans

Nationwide Consultants

Our Experience

With over 30 years in the financial services industry, Roddy Life Planning Group has helped hundreds of clients nationwide protect their future, reduce tax burdens, and secure smarter retirements. Our experience spans across key areas that matter most to families and professionals today.

Tax-Free Retirement Planning

Living Benefits Strategy

Client Education & Support

Your IUL (Safe Money) Specialist

Over 30 years of financial leadership, focused on helping you build tax-free retirement strategies with confidence.

Troy D. Roddy, LUTCF

CEO & Managing Partner

Frequently Asked Question

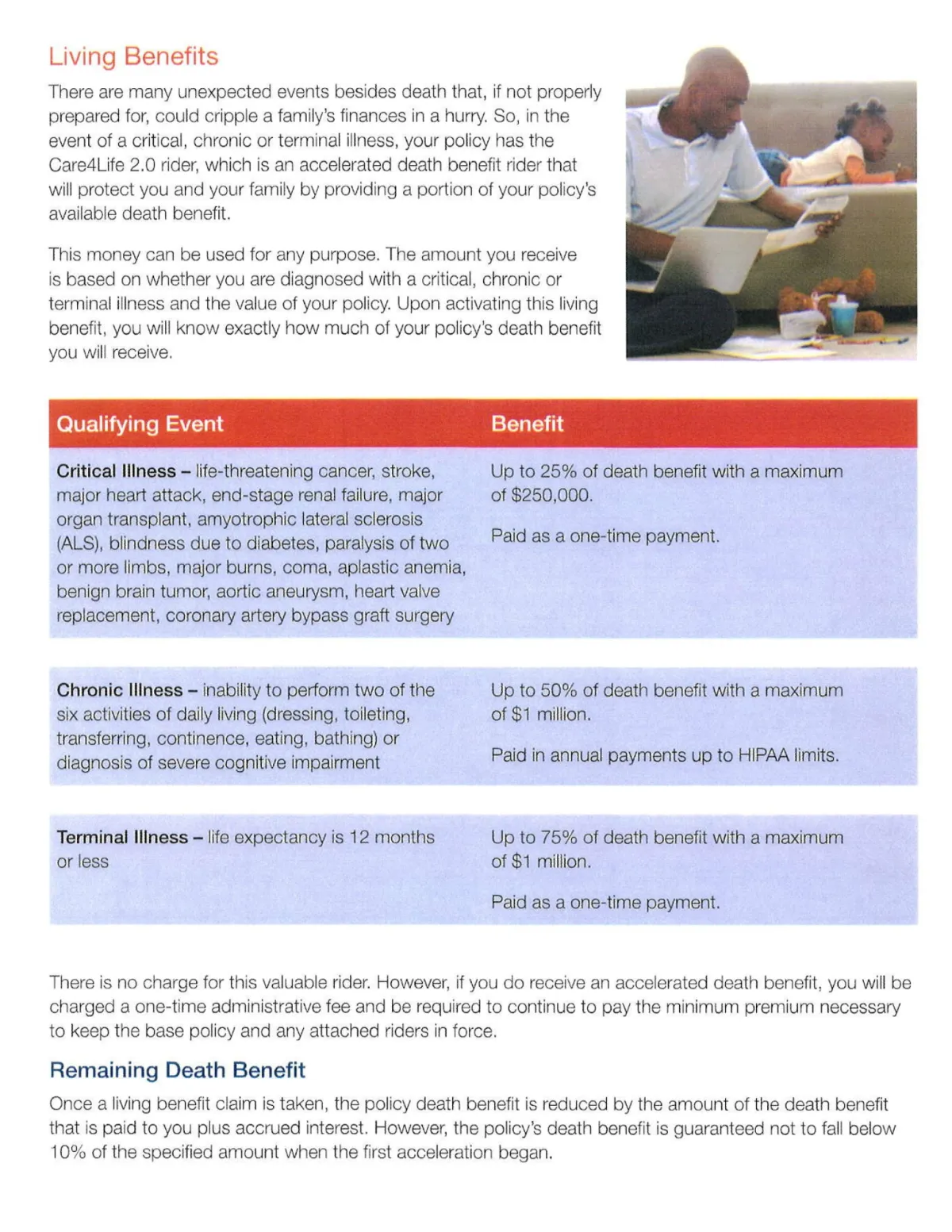

What are living benefits, and how do they work?

Living benefits let you access part of your life insurance payout while you’re still alive — if you're diagnosed with a critical, chronic, or terminal illness. This money can be used however you need: medical bills, caregiving, or everyday expenses. There is not a waiting period and it covers up to 18 items.

How much can I receive if I get sick?

It depends on the type of illness and your policy size. For example, you may receive up to:

25% for critical illness (like heart attack or cancer)

50% for chronic illness (like needing daily care)

75% for terminal illness

Some benefits can go up to $1 million, and payments are either one-time or spread annually.

What’s the difference between term, permanent, and Indexed Universal Life (IUL)?

Term insurance covers you for a specific period—typically 10–30 years—and tends to be more affordable.

Permanent insurance (like Whole or Universal Life) lasts your lifetime and builds cash value.

IUL is a type of permanent insurance that offers tax‑deferred cash value growth linked to market indexes—with a guaranteed floor to shield you from negative market returns.

Testimonial

Don’t take our word for it, hear what our happy clients have to say

Troy was super helpful in walking me through all the steps. He takes great care of his clients and is very knowledgeable. 10/10 would recommend!

Mark Trang

Talking with real people meant a lot. I initially asked about 2 different IUL policies, and ended buying 4, which we need anyway. Everyone at their office was very easy to work with.

Katrina Spencer

Want to see if an IUL is right for your financial goals?

Get In Touch

Phone Numbers:

Office: (708) 401-RLPG

Cell: (708) 738-3805